Skip to main content

Indigenous Communities

Business

-

Indigenous Communities

Trust Services

Financing

Banking

-

Business

-

Personal

Investing

Planning

Ways to Pay

Convenient ways to pay and send money

Features

- Shop online at millions of websites and apps around the world where MasterCard is accepted. Mastercard Zero Liability means you won't be held responsible for unauthorized charges made with your card so you can shop with confidence. Click here to see where you can use your Debit Mastercard in Canada.

- Book flights, hotels and other reservations online where Mastercard is accepted.

- Setup recurring payments for utility payments, subscriptions and streaming services.

- Tap to pay for purchases under $250 using Interac® Flash at retailers across Canada.

- Pay with your debit card at retailers around the world where MasterCard is accepted.

- Make surcharge-free withdrawals and deposits at THE EXCHANGE® network ATMs across Canada. Make surcharge-free withdrawals when travelling in the USA.

- Access cash at ATMs in Canada and around the world where Interac® and Mastercard are accepted.

Getting and Activating a Debit Mastercard

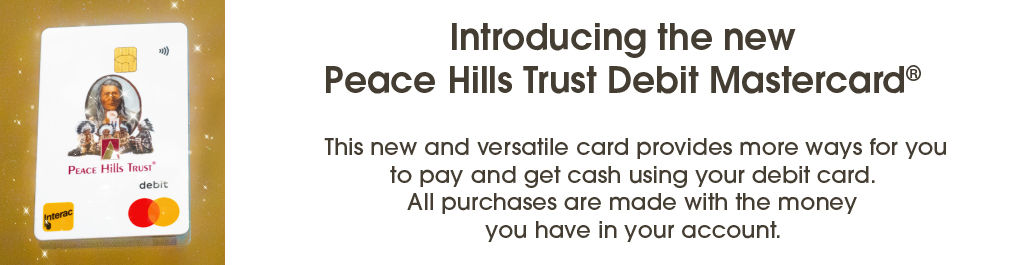

- Your current Peace Hills Trust debit card will be replaced with a Peace Hills Trust Debit Mastercard.

- Beginning in February 2025, customers will receive their new Peace Hills Trust Debit Mastercard by mail

- You will be able to use your existing PIN with your new card.

- When you receive your Debit Mastercard, you’ll have to activate it by making a transaction using your chip and PIN number at a store or an ATM.

- Once your card is activated, you can login to Online Banking or the Mobile App using your new card number (now on the back of the card) and your personal access code (PAC).

Peace Hills Trust has joined THE EXCHANGE Network

You can now use your Peace Hills Trust debit card at thousands of THE EXCHANGE network surcharge-free ATMs across Canada.

You can also make deposits to your Peace Hills Trust account at most of THE EXCHANGE Network ATMs.

Look for THE EXCHANGE logo at the ATM to make surcharge-free withdrawals, deposits and balance inquiries.

When travelling in the USA, you can now use Appoint® network and Accel® network surcharge-free ATMs to make withdrawals and balance inquires.

Use THE EXCHANGE ATM locator to find a surcharge-free ATM in Canada or the USA.

Debit Mastercard FAQ

Transactions, Holds and Card Limits

Protecting Your Debit Mastercard and You

Replacing Your Card

What happened to my Debit Card?

Your debit card has been replaced with Debit Mastercard that allows you to do more. It can be used to make purchases online, in-store locally and wherever Mastercard is accepted worldwide. You can use debit Mastercard anywhere you would use Mastercard while travelling. Any purchases made with your new debit Mastercard are paid directly from your personal chequing account.

Is the Peace Hills Trust Debit Mastercard a Credit Card?

No, the Debit Mastercard is a debit card that can be used where Mastercard is accepted. Any purchases made with the debit Mastercard are paid with funds you have in your personal chequing account. Therefore, you must always ensure you have sufficient funds in your account when making purchases.

Who can have a Debit Mastercard?

All customers have access to the Debit Mastercard no matter their age. However, customers under the age of 12 must have a parent or guardian sign a Cardholder agreement just as with your previous debit card. Youth ages 12 to 18 do not need to have consent from a parent or guardian.

Why does my new card have an Interac and Mastercard logo?

Your new card has both logos to highlight that you can make purchases using both payment networks. Purchases made in-store in Canada are debit transactions processed by Interac, whereas online and international debit transactions are processed by Mastercard.

Where can I use my Debit Mastercard?

- Canadian Merchants In-Store, Online, Over the Phone, and By Mail

-

- Debit Mastercard is accepted in-store, online and in mobile apps, over the phone, and by mail at participating merchants in Canada.

-

- It can also be used to pay for any recurring payments you may have (e.g., Netflix, Amazon, subscription services, etc.) and even for paying your monthly bills (e.g., Epcor, Rogers, Telus, etc.).

- International Merchants (Including US) Online, Over the Phone and By Mail

-

- Debit Mastercard is accepted by US and international retailers that accept Mastercard online, in mobile apps, by telephone and mail order.

- In Stores Outside Canada

-

- When shopping in stores outside of Canada, Debit Mastercard is accepted wherever Mastercard is accepted. Look for the Mastercard acceptance mark.

- Note: The payment methods for eCommerce (online transactions) are determined by the retailer, so some online retailers may not accept payments by Debit Mastercard. Please check the retailer’s website to confirm accepted payment methods.

Does my Debit Mastercard work at ATMs?

- In Canada

-

- Your Debit Mastercard works at Canadian ATMs, but the transaction will be processed by Interac or THE EXCHANGE network. Like with your debit card, you simply insert the card into the ATM, enter your PIN, and select the desired function (withdraw cash, make deposits, transfer funds, check account balances).

- Outside Canada

-

- Your Debit Mastercard can be used to withdraw funds directly from your bank account at millions of ATMs around the world. Just look for the Mastercard acceptance mark.

-

- When travelling in the USA, you can use Appoint® network and Accel® network surcharge-free ATMs to make withdrawals and balance inquires.

Why is my Debit Mastercard not working for online purchases?

This is a security feature; before making online purchases, you’ll have to activate your card by completing a chip and PIN transaction at a store, ATM, or a Peace Hills Trust branch.

How are purchases made with my debit Mastercard processed to my account?

All ATM and point of sale (POS) transactions completed within Canada are processed the exact same way as your existing debit card. Transactions completed via eCommerce (online), telephone, or International POS are processed on the Mastercard network. This means that transactions will process similar to how credit card transactions are processed. At the time of purchase, a hold is placed on your account for the amount of the purchase or pre-authorization. When the merchant processes their card transactions or when the order has been fulfilled, the purchase will debit your chequing account, and the hold will be released.

I made a purchase online with my debit Mastercard, why did the available balance in my account decrease but I don't see the charge in my online banking?

It’s possible a hold for a larger dollar value than the actual purchase has been placed on your account. An example of when this might occur is when you’re paying at a gas pump and select “fill” instead of a specific dollar amount. A hold is placed on your account for the larger pre-authorized amount however you will only be charged the amount it took to fill your gas tank.

I returned an item I bought online; how soon will my refund show up in my card?

Return transactions for items bought online may take up to seven days to be credited to your account. The speed of your return depends on how quickly the store you purchased the item from processes it in their system.

What should I do if there's a transactions charged to my account that I disagree with?

- If you have a dispute about an online purchase and haven’t been able to resolve it with the store/vendor, you may contact us. We must know of the dispute within 90 days of the date of purchase and the expected date of delivery. Disputes may take 8-12 weeks (about three months) to resolve.

- Please note that if you made a purchase and the store has not provided you with the goods or services or the goods/services are not as described, we may be able to assist you. However, we will not be able to assist you in disputes about the quality or suitability of the purchase, nor can we help with any PIN transactions.

- If you receive reimbursement from the store no further action can be taken by Peace Hills Trust to claim a refund.

Are there any limits on the new Debit Mastercard?

The default daily limits are the same as your existing debit card.

Are there any limits to contactless (tap) payments (Interac Flash®)?

Yes, the limits are the same as your existing debit card. Completing a PIN transaction will reset the cumulative total to zero.

Are there any transaction fees for my Debit Mastercard?

The same fees that applied to your debit card also apply to your new debit Mastercard. Additionally, any international transactions may be charged a foreign transaction fee. For more information on transaction fees, click here.

How do I keep my card safe?

For added security, your PAN (personal account number) is located on the back of your card. Remember to keep your PIN safe by choosing one that isn't obvious and shield while using it.

Does my debit Mastercard have any safety features against fraud?

To combat fraud, solutions are in place to proactively monitor and detect fraud in real-time.

I received an OTP (One-Time Password) while completing an online transaction, why?

Some merchants are set up as 3D Secure merchants. These merchants may require an OTP to be sent to your email or phone number to confirm your identity.

I received an SMS (text message) about a purchase I made online or out of country, why?

- A text message will be sent to you when you make a purchase outside of the country or online.

- An SMS is sent for every approved transaction that takes place internationally or online to inform the cardholder of the activity.

- For online purchases the message will be received by you when the merchant sends the approval request on your card and places the hold, not necessarily when the purchase is made or when the debit is processed out of your account.

- The text message will always come from 1-418-579-2603.

What happens if my Debit Mastercard was used to complete unauthorized transactions on my account?

- Your Debit Mastercard is covered by Interac and Mastercard’s Zero Liability policy, which means you won’t be liable for any unauthorized transactions that occur using your Debit Mastercard where you have:

-

- Exercised reasonable care in safeguarding your debit card and PIN from any unauthorized use, loss, or theft.

-

- Immediately reported to Peace Hills Trust any loss or theft of the Debit Mastercard.

-

- Notify Peace Hills Trust of the unauthorized transactions within a reasonable time.

What do I do if I suspect fraud on my card?

To report your card as lost or stolen or for assistance with other items, please call us at 1-855-801-5769 or contact your branch.

How do I order a new debit Mastercard to replace a lost, stolen, or broken one?

- Visit your local branch to get a permanent replacement by visiting your local branch. However, this card will not have your same card number and will not have your name on it.

- If you are unable to visit a branch, your branch will be able to order a replacement card that will be mailed to you.

- You may incur a card replacement fee. This also applies if you habitually lose your card and require more than one replacement. You can see a full list of transaction fees here.

My Card was reported lost/stolen and I've received my replacement card, what do I do now?

Be sure to update any online accounts that have your old card number stored (ie. subscriptions, pre-authorized payments, websites, etc.). When you receive your replacement card, you’ll have to activate it by making a transaction using your chip and PIN number at a store or a credit union ATM.

PHT Cardholder Agreement

Note: Use of your Peace Hills Trust debit card is governed by the terms of the Peace Hills Trust Cardholder agreement.

Interac® e-Transfer

Whether you owe a friend for pizza, need to pay your rent or someone owes you money we've got you covered with Interac e-Transfer.

OVERVIEW

SEND/RECEIVE

AUTO DEPOSIT

REQUEST MONEY

FAQS

Overview

It's easy. All you need to send or receive money is the recipient's email address or mobile phone number. When you register for Autodeposit, any transfers sent to you will be automatically deposited into your pre-selected bank account.

It's convenient. Send or request money anytime using online banking or the Peace Hills Trust mobile app. Receive notifications by email address or by text message.

It's safe. When you send money using Interac e-Transfer, the money is transferred using established and secure banking systems. Money never travels by email or text – these methods are used to notify you that money has been sent or requested with instructions to deposit it.

Send and Receive Money

Send money to anybody with an account at any Canadian financial institution – all you need is their email address or mobile number.

To send an Interac e-Transfer from Online Banking:

- Login to Online Banking.Create a profile, if you have not already done so.

- Select Send Interac e-Transfer under Transfer.

- Select a Recipient and choose email and/or text message.

-

Follow the instructions on the page.

Receive an Interac e-Transfer by email or SMS text message. To deposit the money, select the link in the email or text message notification you receive from Interac and the follow the instructions to login and deposit your money.

Autodeposit – the easy way to receive money

- You can get your money even faster with Autodeposit. Use online banking or the Peace Hills Trust mobile app to register your email address and preferred bank account.

- You will receive notification via email and/or text message when an Autodeposit has occurred.

- Autodeposit is free.

- For more information about AutoDeposit see e-Transfer FAQ.

Request Money –helps you collect money you are owed

- Does your friend owe you for dinner? Request Money makes it easier for friends and family to send you the money they owe you.

- Recipients will get a “Request Money” notification through email or text message and can fulfill the request though their own Canadian financial institution using Interac e-Transfer.

- If the recipient accepts your request then you are notified once the money is deposited directly into your Peace Hills Trust bank account.

- If you receive a request for money notification verify that you know the sender and following the instructions in the notification to login to online banking or the Peace Hills Trust mobile app to fulfill the request.

- The maximum daily request amount is $3,000 (weekly and monthly limits also apply).

- Request Money is free.

- For more information about Request Money see e-Transfer FAQ.

Frequently Ask Questions

How much does it cost?

There is $1.50 fee to send money. Receiving money, AutoDeposits, Requesting Money and fulfilling requests for money are free.

How much can I send using Interac e-Transfer?

Send as little as you want up to a maximum of:

- $3,000 within a 24 hour period

- $10,000 within a 7 day period

- $20,000 within a 30 day period

How do I cancel an e-Transfer and deposit the money back into my bank account?

You can cancel the transfer anytime until the recipient accepts it. Generally, it takes 30 minutes for notifications to be sent to recipients. To cancel a transfer, click on the 'Cancel' link beside the list of pending transfers.

How long does it take to receive the money?

It may take approximately 30 minutes for notifications to be received. As soon as the notification is received, the recipient can deposit the money. Auto deposit may take the same time as a regular Interac e-Transfer.

How do I know when the e-Transfer I sent has been successfully received and deposited?

You will receive an email notice or text message that the recipient has claimed the transfer and deposited it into their bank account. You will receive an email notice that an Auto deposit has been completed.

How will I be notified if a request for money is sent to me?

Similar to receiving money via e-Transfer, when someone requests money you will receive a notification via email or a text message.

Can money requests be used by fraudsters for phishing?

Notifications from Interac via SMS or email for Send or Request Money transfers could be utilized for phishing purposes. Since phishing is generally used to gather online banking credentials, you should only respond to Interac notifications from senders you know. Interac does provide the legal name of individuals and businesses for Request Money transfers in their notifications which can help you determine if the notification is legitimate.

How do I fulfill an Interac e-Transfer request for money?

You will need to click the link that appears in the notification to login to online banking. From there, you can fulfill the request by choosing the account for the funds to be withdrawn from. The requestor will receive a notification once the funds are deposited into their account.

Can I decline a request for money?

Yes, you can decline a request for money by selecting the decline option within the notification or on the Interac page showing details of the request. If you provide a reason for declining the request, this information will be sent to the requestor.

Can I block a requestor from requesting funds from me or opt-out out of the Request Money feature?

Yes, you can opt-out of receiving requests from a particular requestor, or of the service completely, by selecting the opt-out option from the request notification email.

Send Money

Auto Deposit

Request Money

Interac®, Interac Flash® and the Interac logo are trademarks of Interac Corp. Used under license.

© Copyright 2025 Peace Hills Trust Company. All rights reserved.